Missouri Property Tax Calculator Car . The department collects taxes when an applicant applies for title. market value of vehicles is determined by the october issue of the nada. Estimate your taxes when you purchase your new vehicle with this handy calculator. please contact the state auditor’s tax rate section if you have any questions regarding the calculation of property taxes at 573. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Just bought a new car or thinking about buying? Once market value has been determined, the assessor. Compare your rate to the missouri and u.s. our missouri property tax calculator calculates the taxes you’ll pay after buying a property. to calculate taxes owed on a $100,000 vehicle at a 6.5694 total tax rate per $100 of assessed valuation: motor vehicle, trailer, atv and watercraft tax calculator.

from www.signnow.com

motor vehicle, trailer, atv and watercraft tax calculator. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Just bought a new car or thinking about buying? Once market value has been determined, the assessor. Compare your rate to the missouri and u.s. Estimate your taxes when you purchase your new vehicle with this handy calculator. please contact the state auditor’s tax rate section if you have any questions regarding the calculation of property taxes at 573. our missouri property tax calculator calculates the taxes you’ll pay after buying a property. to calculate taxes owed on a $100,000 vehicle at a 6.5694 total tax rate per $100 of assessed valuation: The department collects taxes when an applicant applies for title.

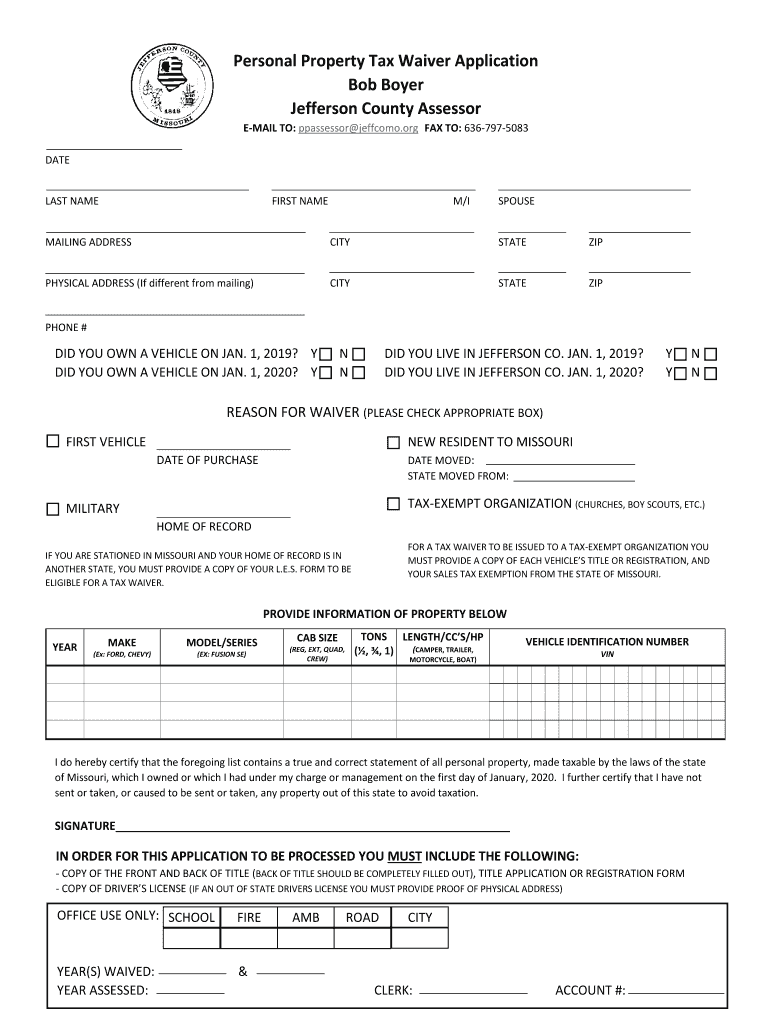

Personal Property Tax Jefferson County Mo 20192024 Form Fill Out and

Missouri Property Tax Calculator Car Compare your rate to the missouri and u.s. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. please contact the state auditor’s tax rate section if you have any questions regarding the calculation of property taxes at 573. Compare your rate to the missouri and u.s. Once market value has been determined, the assessor. to calculate taxes owed on a $100,000 vehicle at a 6.5694 total tax rate per $100 of assessed valuation: our missouri property tax calculator calculates the taxes you’ll pay after buying a property. Just bought a new car or thinking about buying? Estimate your taxes when you purchase your new vehicle with this handy calculator. The department collects taxes when an applicant applies for title. motor vehicle, trailer, atv and watercraft tax calculator. market value of vehicles is determined by the october issue of the nada.

From hxedwbtbd.blob.core.windows.net

Jackson County Missouri New Car Sales Tax at James Carter blog Missouri Property Tax Calculator Car Just bought a new car or thinking about buying? our missouri property tax calculator calculates the taxes you’ll pay after buying a property. Compare your rate to the missouri and u.s. motor vehicle, trailer, atv and watercraft tax calculator. to calculate taxes owed on a $100,000 vehicle at a 6.5694 total tax rate per $100 of assessed. Missouri Property Tax Calculator Car.

From prorfety.blogspot.com

Personal Property Tax Receipt Kansas City Missouri PRORFETY Missouri Property Tax Calculator Car Estimate your taxes when you purchase your new vehicle with this handy calculator. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Once market value has been determined, the assessor. The department collects taxes when an applicant applies for title. please contact the state auditor’s tax rate section if. Missouri Property Tax Calculator Car.

From www.slideserve.com

PPT Use Online Property Tax Calculator for Estimating Value of P Missouri Property Tax Calculator Car to calculate taxes owed on a $100,000 vehicle at a 6.5694 total tax rate per $100 of assessed valuation: calculate how much you'll pay in property taxes on your home, given your location and assessed home value. please contact the state auditor’s tax rate section if you have any questions regarding the calculation of property taxes at. Missouri Property Tax Calculator Car.

From prorfety.blogspot.com

What Is The Property Tax In Missouri PRORFETY Missouri Property Tax Calculator Car to calculate taxes owed on a $100,000 vehicle at a 6.5694 total tax rate per $100 of assessed valuation: Just bought a new car or thinking about buying? please contact the state auditor’s tax rate section if you have any questions regarding the calculation of property taxes at 573. market value of vehicles is determined by the. Missouri Property Tax Calculator Car.

From www.formsbank.com

Form MoPtc Missouri Book Property Tax Credit Claim 2011 printable Missouri Property Tax Calculator Car to calculate taxes owed on a $100,000 vehicle at a 6.5694 total tax rate per $100 of assessed valuation: The department collects taxes when an applicant applies for title. Compare your rate to the missouri and u.s. Estimate your taxes when you purchase your new vehicle with this handy calculator. motor vehicle, trailer, atv and watercraft tax calculator.. Missouri Property Tax Calculator Car.

From www.pdffiller.com

2022 Form MO DoR MOPTS Fill Online, Printable, Fillable, Blank pdfFiller Missouri Property Tax Calculator Car market value of vehicles is determined by the october issue of the nada. our missouri property tax calculator calculates the taxes you’ll pay after buying a property. to calculate taxes owed on a $100,000 vehicle at a 6.5694 total tax rate per $100 of assessed valuation: The department collects taxes when an applicant applies for title. Once. Missouri Property Tax Calculator Car.

From exopeuvjk.blob.core.windows.net

How To Pay Personal Property Tax Platte County Missouri at Brian Faul blog Missouri Property Tax Calculator Car please contact the state auditor’s tax rate section if you have any questions regarding the calculation of property taxes at 573. Just bought a new car or thinking about buying? to calculate taxes owed on a $100,000 vehicle at a 6.5694 total tax rate per $100 of assessed valuation: our missouri property tax calculator calculates the taxes. Missouri Property Tax Calculator Car.

From www.buyhomesincharleston.com

How Property Taxes Can Impact Your Mortgage Payment Missouri Property Tax Calculator Car Once market value has been determined, the assessor. motor vehicle, trailer, atv and watercraft tax calculator. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Compare your rate to the missouri and u.s. The department collects taxes when an applicant applies for title. Just bought a new car or. Missouri Property Tax Calculator Car.

From www.taxmypropertyfairly.com

Calculators for Property Taxes Missouri Property Tax Calculator Car our missouri property tax calculator calculates the taxes you’ll pay after buying a property. to calculate taxes owed on a $100,000 vehicle at a 6.5694 total tax rate per $100 of assessed valuation: The department collects taxes when an applicant applies for title. Once market value has been determined, the assessor. please contact the state auditor’s tax. Missouri Property Tax Calculator Car.

From hxedwbtbd.blob.core.windows.net

Jackson County Missouri New Car Sales Tax at James Carter blog Missouri Property Tax Calculator Car calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Estimate your taxes when you purchase your new vehicle with this handy calculator. please contact the state auditor’s tax rate section if you have any questions regarding the calculation of property taxes at 573. Just bought a new car or. Missouri Property Tax Calculator Car.

From infotracer.com

Missouri Property Records Search Owners, Title, Tax and Deeds Missouri Property Tax Calculator Car calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Once market value has been determined, the assessor. Compare your rate to the missouri and u.s. The department collects taxes when an applicant applies for title. motor vehicle, trailer, atv and watercraft tax calculator. Estimate your taxes when you purchase. Missouri Property Tax Calculator Car.

From taxfoundation.org

To What Extent Does Your State Rely on Property Taxes? Tax Foundation Missouri Property Tax Calculator Car our missouri property tax calculator calculates the taxes you’ll pay after buying a property. The department collects taxes when an applicant applies for title. Just bought a new car or thinking about buying? Compare your rate to the missouri and u.s. calculate how much you'll pay in property taxes on your home, given your location and assessed home. Missouri Property Tax Calculator Car.

From www.propertytaxcalculator.us

Property Tax Calculator Missouri Property Tax Calculator Car calculate how much you'll pay in property taxes on your home, given your location and assessed home value. market value of vehicles is determined by the october issue of the nada. please contact the state auditor’s tax rate section if you have any questions regarding the calculation of property taxes at 573. Once market value has been. Missouri Property Tax Calculator Car.

From kxkx.com

Missouri Has One of the Highest Vehicle Property Tax Rates Missouri Property Tax Calculator Car Compare your rate to the missouri and u.s. market value of vehicles is determined by the october issue of the nada. Once market value has been determined, the assessor. motor vehicle, trailer, atv and watercraft tax calculator. The department collects taxes when an applicant applies for title. calculate how much you'll pay in property taxes on your. Missouri Property Tax Calculator Car.

From calculatoradam.com

Property Tax Calculator by Zip Code [2024] Calculator Adam Missouri Property Tax Calculator Car our missouri property tax calculator calculates the taxes you’ll pay after buying a property. Estimate your taxes when you purchase your new vehicle with this handy calculator. market value of vehicles is determined by the october issue of the nada. please contact the state auditor’s tax rate section if you have any questions regarding the calculation of. Missouri Property Tax Calculator Car.

From de.slideshare.net

Use Online Property Tax Calculator for Estimating Value of Property T… Missouri Property Tax Calculator Car Estimate your taxes when you purchase your new vehicle with this handy calculator. Once market value has been determined, the assessor. motor vehicle, trailer, atv and watercraft tax calculator. Just bought a new car or thinking about buying? market value of vehicles is determined by the october issue of the nada. our missouri property tax calculator calculates. Missouri Property Tax Calculator Car.

From hxedwbtbd.blob.core.windows.net

Jackson County Missouri New Car Sales Tax at James Carter blog Missouri Property Tax Calculator Car The department collects taxes when an applicant applies for title. our missouri property tax calculator calculates the taxes you’ll pay after buying a property. Compare your rate to the missouri and u.s. Estimate your taxes when you purchase your new vehicle with this handy calculator. please contact the state auditor’s tax rate section if you have any questions. Missouri Property Tax Calculator Car.

From www.pdffiller.com

2013 Form MO MOPTC Chart Fill Online, Printable, Fillable, Blank Missouri Property Tax Calculator Car to calculate taxes owed on a $100,000 vehicle at a 6.5694 total tax rate per $100 of assessed valuation: Compare your rate to the missouri and u.s. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. The department collects taxes when an applicant applies for title. please contact. Missouri Property Tax Calculator Car.